Taxes Personales

Taxes are amounts of money that people contribute to cover the costs of running a country or a community. For example, taxes pay for schools, hospitals, and roads. When immigrants and citizens pay taxes, they are paying their share of programs that benefit them.

What if I am undocumented?

If you have income in the United States, the law says that you must pay taxes even if you are not a legal resident. You can use an ITIN to pay taxes.

Paying taxes while undocumented can help show that you have “good moral character.” Demonstrating good moral character is important if you are applying for cancellation of removal, a green card, or another immigration program in the future.

A tax return is a document that must be submitted to the government that shows the amount of income you earned in a given year. For personal federal tax returns, there are different forms, as well as different eligibility requirements that you must first meet.

Income Documentation:

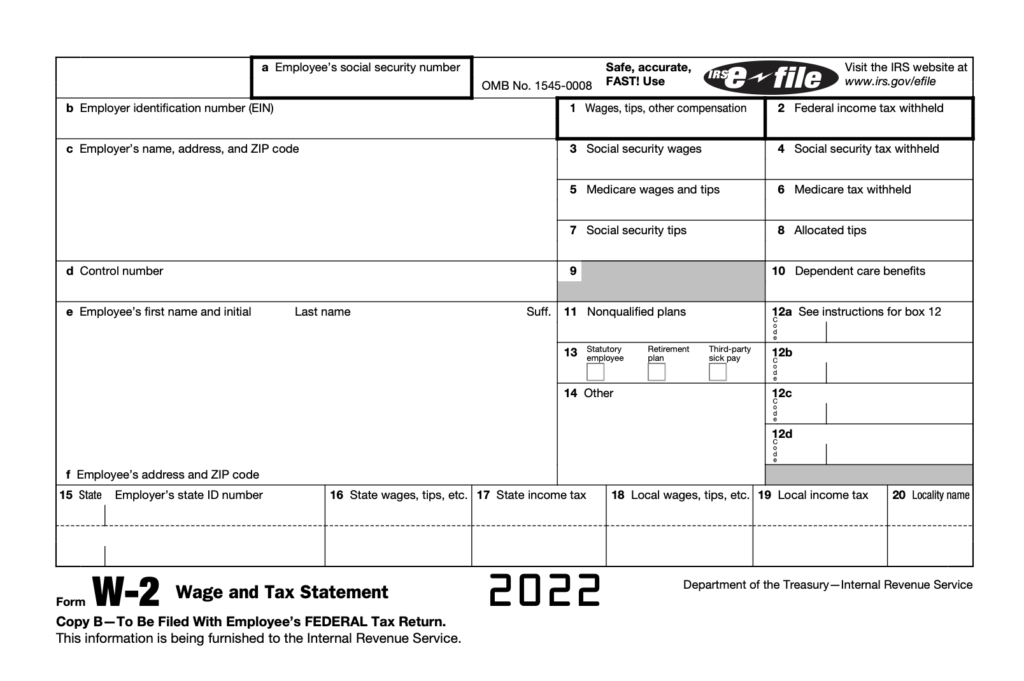

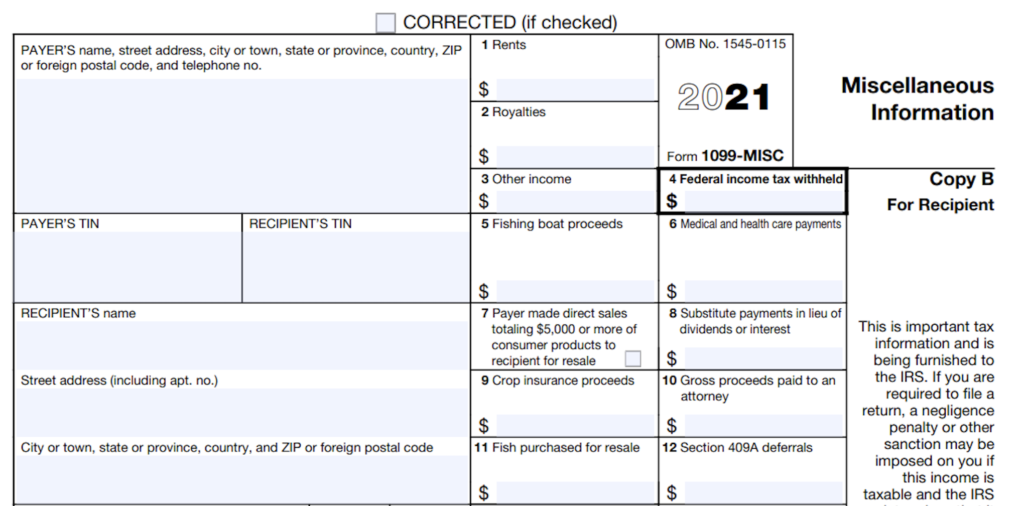

El primer dato que necesita para empezar a preparar su declaración de la renta es la cantidad total de ingresos que obtuvo durante el año. Cualquier empleador que le pague un salario debe enviarle un formulario W-2 cada año, que informa de sus ingresos anuales y la cantidad de impuestos retenidos. Los contratistas independientes suelen recibir informes de ingresos en el formulario 1099. Si es empresario individual, usted es responsable de recopilar toda la información relativa a los beneficios o pérdidas de su empresa.

If you have dependents you need to include the following documents in the declaration:

Birth certificate

Medical record

Medical appointment document

Hospital / Clinic discharge document

School transcript

Report card

Lista de requisitos necesarios para la declaración de la renta:

- Ingresos (W-2 o 1099, ingresos por desempleo, etc.), tarjeta de la seguridad social, documento de identidad, fechas de nacimiento de todos los solicitantes.

- No olvide incluir sus gastos médicos, intereses de la vivienda, donaciones, uniformes, kilometraje, gastos de canguro o manutención de los hijos (pensión alimenticia), etc.

- Lleve un resumen de todos los gastos a incluir en la declaración (el preparador no puede hacerlo por usted).

- Es importante que informe a su preparador si tiene o ha tenido problemas con Hacienda en años anteriores, especialmente con el crédito por ingresos del trabajo.

- Procure proporcionar siempre la dirección y los números de teléfono correctos donde se pueda contactar con el IRS en caso de que desconecte la línea o esté fuera de servicio.

- Es importante que ambos cónyuges estén presentes si presenta una declaración conjunta con su cónyuge.

- Si necesita reclamar un crédito, añadir un dependiente que no incluyó en su declaración, olvidó incluir un W-2 o cualquier ingreso. También hacemos enmiendas o modificaciones a declaraciones ya presentadas.

- También preparamos declaraciones de años anteriores.

- FORM 1099 - MISC

-

FORM W- 2